Rather watch Ara explain the market commentary in a video? Click here to watch.

Back in October, I wrote about interest rates and my belief that the Federal Reserve would abandon their “higher for longer” mantra and start cutting midway through 2024. The subsequent inflation data backed this up, and the Fed changed from “higher for longer” to “expect three rate cuts” in 2024. This led to a monumental year-end rally for both stocks and bonds.

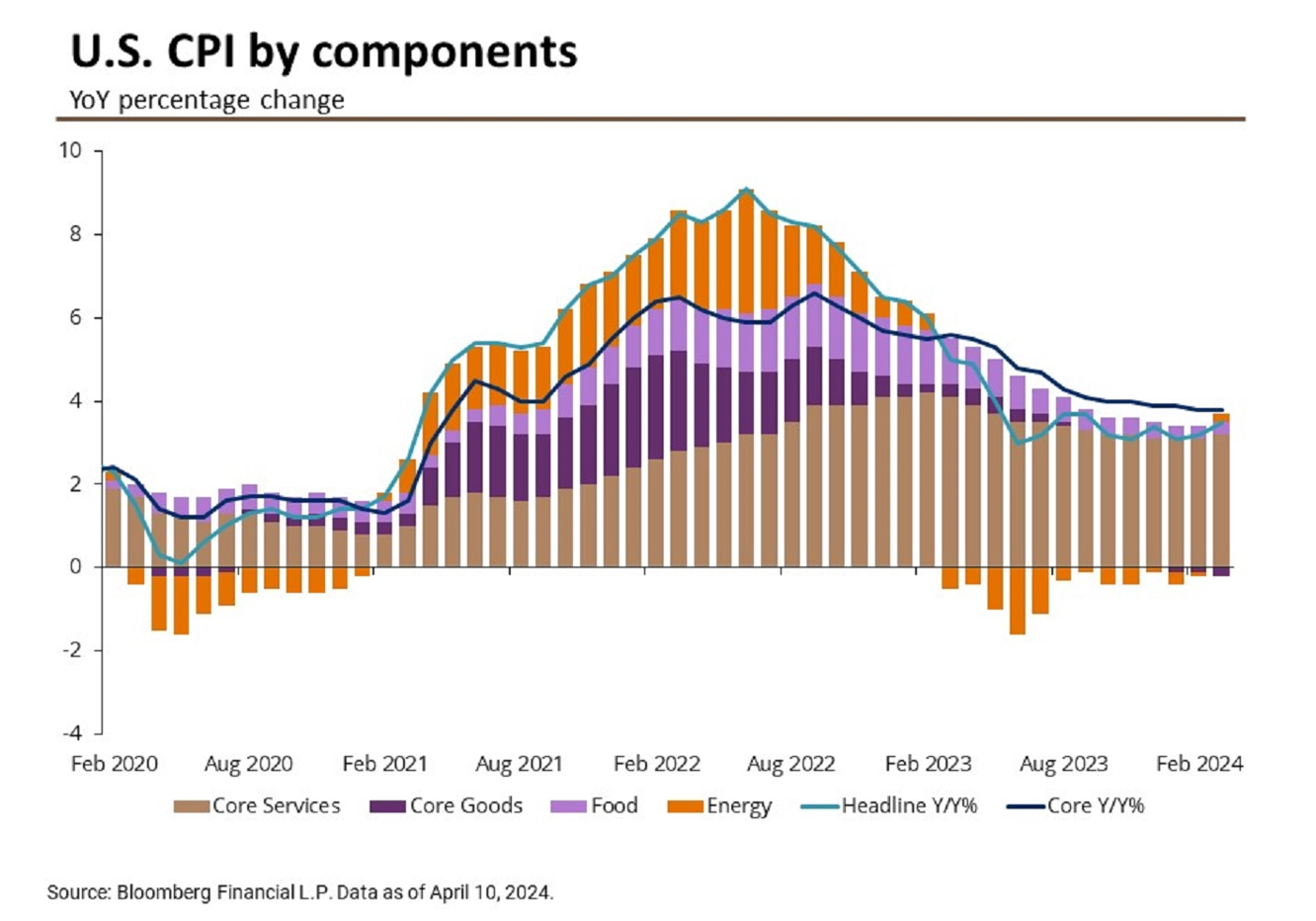

While we experienced an unexpected bump in inflation in both January and February, Fed Chairman Powell indicated that these data points did not fundamentally change the Fed’s plan. Unfortunately, March marked the third consecutive month-over-month increase in the Consumer Price Index (CPI), which spooked stock and bond markets. This led the Fed to pivot, once again, to a higher-for-longer stance.

While Powell did not indicate the need to raise rates, many Fed committee members have floated the idea. Here lies the issue. Sometimes, less is more. The Fed already has a tough enough job trying to accurately predict interest rate policy with a global economy that is constantly changing. Unfortunately, this challenge does not stop the various Fed members from opining their thoughts on what feels like a daily occurrence, quite often contradicting other members.

The Fed employs more than 500 researchers, including 400-plus PhD economists, and is continually trying to play catch-up, as evidenced by their continual flip-flopping on interest rate policy over the past eight months! This, in my opinion, leads to excess confusion and a lack of confidence in the Fed, which creates additional volatility as markets constantly try to adjust on the fly. One thing we know is that markets dislike uncertainty!

Now, barring a significant decline in inflation or global economic growth, the Fed seems to have embraced a higher-for-longer outlook. Inflation can be sticky, which makes achieving desired targets extremely difficult. The question that is starting to re-emerge is: Why own bonds over cash if “higher for longer” is the new reality for the foreseeable future?

While this seems like a sensible idea on paper, most investors forget that markets are forward-looking, and when things seem their bleakest, the tide generally starts to turn. A case in point is the tail end of 2023. Both stocks and bonds struggled as interest rates surged and rate hikes were back on the table. The sentiment was extremely negative, and the question of “Why own bonds?” surfaced.

If an investor had acted on that impulse, they would be kicking themselves as inflation data unexpectedly cooled in November and December. This cooling-off led rates to plummet and the Fed to pivot and indicate three rate cuts for 2024.

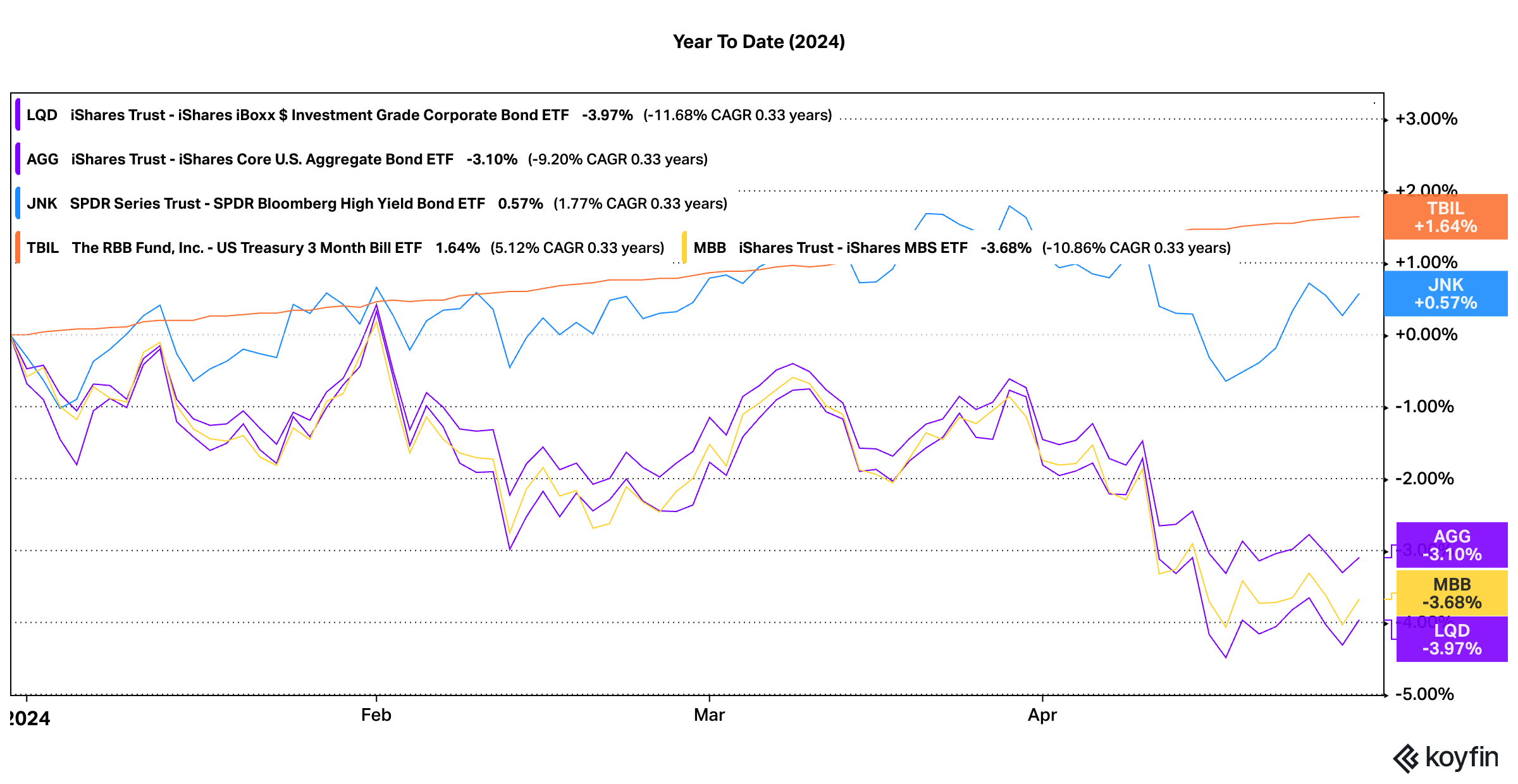

As seen on the chart above, most bonds rallied between 8% and 12% while the three-month U.S. T-Bill, considered a “cash equivalent,” gained ~1%. Missing out on returns of this magnitude can significantly reduce your total portfolio return. Many investors felt FOMO and moved cash into these bonds, chasing returns with the assumption that it would be smooth sailing. Unfortunately, that did not transpire, as most of these same bonds have declined 3% to 4% this year. While on the other hand, the three-month U.S. T-Bill has yielded a positive return as “higher for longer” seems like a more realistic scenario.

As investors, we are used to volatility in stocks, not bonds. We have experienced, by far, the most volatility in bond market history over the past several years. As seen on the chart below, the U.S. Aggregate Bond Index has experienced FIVE straight years of a 4 percent or greater sell-off during each calendar year!

Why do I bring this up? As investors, we need to resist the urge to chase yields and returns. As a refresher, bonds have a predetermined interest rate and repayment date (maturity). While the underlying price can fluctuate before maturity, investment-grade bonds rarely default, making investors whole in the end.

Now, this doesn’t mean you should do nothing, but trying to time interest rate moves is not recommended. We generally recommend a barbell approach, meaning you own both shorter- AND intermediate-duration bonds. Doing so allows you to reduce volatility while still earning a competitive yield on the bond portion of your portfolio. Most importantly, it helps eliminate the urge to try to time things.

Volatility will likely remain until we get a better handle on the direction of inflation and interest rates. The good news is that we are closer to rate cuts than rate hikes. While experiencing volatility simultaneously in stocks and bonds can be unsettling, this, too, shall pass.

Stay the course …

Discuss your situation with a fee-only financial advisor.