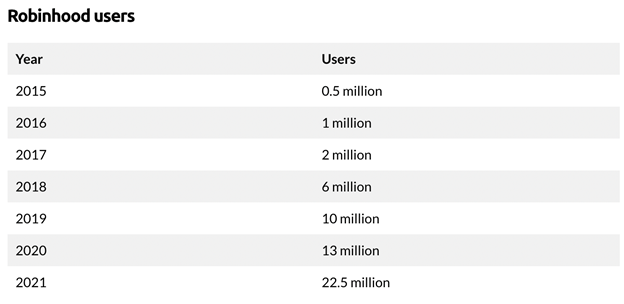

This rise in popularity of Robinhood has been staggering. Established in 2015, Robinhood offers free stock trading to its users, which means no brokerage fees or commissions. In addition, users can also trade cryptocurrency on its platform.

Many initially choose to open a Robinhood account because it provides a low-cost and easy way to invest for themselves or to save for other family members. Robinhood makes it so easy that you can literally buy and sell within seconds from its mobile app. The number of users had been steadily increasing and experienced a meteoric rise in 2021.

Source: Business of Apps.

The increase in popularity was due, in part, to the pandemic causing people to be stuck at home with extra cash to invest as spending plummeted and, concurrently, trillions of stimulus dollars were injected into the pockets of American households.

Then came the meme stock craze involving Robinhood users day-trading a handful of heavily shorted stocks, causing volatility to spike and sending shockwaves to markets. You couldn’t go a single day without hearing about Robinhood.

The purpose of this post is not to bash Robinhood since it serves a good purpose, but as with any other type of trading account, there are rules that you must know before you get started. This is especially true when it comes to taxes, as quite often, these rules are not adequately disclosed from the start.

Because many younger investors are using Robinhood, we look at tax rules affecting families as well. If you have family members using Robinhood, we encourage you to share this article with them.

Robinhood Accounts

Currently, Robinhood offers the ability to open only taxable (non-qualified) investment accounts. The company is weighing whether to add individual retirement accounts (IRAs) and Roth IRAs—those come with a much higher level of scrutiny from financial regulators.

It is important to note that every transaction made on Robinhood is reported to the Internal Revenue Service (IRS) and can turn into a tax nightmare if not reported properly on your tax return. In short, this means that if you sell an investment at a profit, it must be reported on your individual tax return. How much you owe depends on how long you held the investment.

The Tax Man Cometh

When you buy or sell an investment with Robinhood, the standard tax laws apply. What types of taxes can you expect to pay? The length you hold the investment determines the taxes owed.

A common misconception is that you can trade as much as you like, and if you don’t withdraw money, you owe no taxes. While this holds true in retirement accounts, it does not with taxable (non-retirement) investment accounts.

Any investment that is sold and was held for less than a year will incur short-term capital gains.

The profits are taxed as ordinary income, which is your personal income tax rate and can get as high as 37% (federal).

If an investment is sold and it has been over a year, you will incur long-term capital gains:

The profits are taxed at a starting rate of 15%, with the top rate for high earners being 23.8% (federal).

These rates are likely to change. In fact, Congress is considering a bill that would increase the long-term capital gains rate on certain American households. This means that if you wish to pay the lowest amount in taxes on your profits, you might want to consider holding investments for a minimum of one year.

Regardless, just know that depending on where you reside, you could also end up owing state taxes.

It should be noted that if your taxable income is $40,400 per year or less ($80,800 for a married couple), you won’t pay any capital gains taxes.

Even for custodial accounts, the amount of taxes you’ll pay depends on your tax bracket, the child’s tax bracket, and the child’s age. For instance, if your child is under the age of 19 (or 24, if they are a full-time student), the tax structure is:

No taxes are owed for the first $1,050 of unearned income

The next $1,050 of income is taxed at the child’s tax rate

Anything over $2,100 is taxed at the rate of the adult who controls the account

Things to Consider with a Robinhood Account

As mentioned, if you sell an investment and make a profit, you’ll owe taxes. But what happens if you’re selling stocks at a loss? Generally, you can use losses to offset any gains in a calendar year. You can also use them to offset up to $3,000 per year in ordinary income. Plus, you can carry over losses to future years.

Now, this is where things can get tricky, and if not handled properly, you could be left with a massive tax bill. How massive? Several Robinhood traders were hit with tax bills as high as $800,000! The tricky part is something called the “wash sale rule.” If you sell an investment to “capture” the loss for tax purposes, known as “tax loss harvesting,” and immediately repurchase it, you will end up in hot water.

The wash sale rule states that if you sell an investment at a loss and repurchase it within 30 days, you’re not entitled to claim the loss. This rule was put in place to make sure that taxpayers don’t manipulate the system.

Many beginners in the stock market have losses simply because they are new at investing and aren’t sure about the tax laws. If you have concerns, you should seek the help of a tax professional. That said, if you do find yourself with a large tax bill, keep in mind that the IRS allows installment payments.

Retail Investing Is Growing

Individual investors, known as retail traders, continue to grow and now comprise ~10% of daily trading on a majority of the U.S. exchanges. Much of this trend has to do with the rise of online trading apps like Robinhood. They have made trading easier and more cost-effective than ever, which has tempted many to dip their toe in the water.

In January alone, roughly 6 million people downloaded trading apps in the United States! Other countries seem to be experiencing a similar trend. In 2019, trading accounts throughout the world tripled, with Japan noticing a 25% jump in accounts in the first nine months. Many expect this percentage to continue to rise over time.

Conclusion

Accounts like Robinhood have paved the way for everyday people to invest money in a simple and cost-effective manner. The process used to be much more cumbersome and costly, which discouraged many from investing. As with any investment, you should always do the proper research to understand what you are signing up for.

Discuss your situation with a fee-only financial advisor.

The commentary on this website reflects the personal opinions, viewpoints and analyses of the Divergent Planning, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Divergent Planning, LLC or performance returns of any Divergent Planning, LLC Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Divergent Planning, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Divergent Planning, LLC provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Divergent Planning, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Divergent Planning, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Divergent Planning, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Divergent Planning, LLC unless a client service agreement is in place.

General Notice to Users: While we appreciate your comments and feedback, please be aware that any form of testimony from current or past clients about their experience with our firm on our website or social media platforms is strictly forbidden under current securities laws.