As you get closer to retirement, there’s a question you may not have asked yourself but probably should, and that is “Should I move in retirement?” While many pre-retirees focus heavily on when they will retire, not as many think about where they want to retire. After living in one place for an extended period of time, the decision of whether to stay put or find a new place to call home should not be made lightly.

Before leaving the workforce, you have an opportunity to decide where you want to retire. This decision can have a dramatic impact on your finances and quality of life, so consider spending time at potential retirement landing spots to get a feel for the surroundings. Relocating after retirement can be stressful, so being familiar with your environment will help put your mind at ease.

The baby boomer generation retired at a record pace in 2020, selling their homes at a higher rate than any other age group. What’s more, this group was the most likely to move the farthest distance after selling.

For retirees of this generation, the drive to downsize and start a new chapter is evident. Perhaps fueling that drive are the countless annual lists of “the best places to retire.” Truth be told, there isn’t a universal “best,” as it tends to vary from person to person.

Why People Move in Retirement

Ultimately, the decision to move in retirement comes down to several factors. For example, separated, divorced, or widowed seniors may move to be closer to family and friends. Others may want to move to be in a more senior-focused community.

On the flip side, many people move specifically to improve their personal finances. They may decide to downsize to make the most of retirement savings and reduce their living costs. This alone could help stretch your retirement nest egg for a few additional retirement years!

This decision takes careful consideration. For example, retirees who move closer to younger children and other family members might end up in expensive housing markets. Those who move to a retirement community might find a place with a lower cost of living, but they’ll need to factor community fees into their budgets.

This post will analyze a few key issues to think about before deciding.

Cost of Living

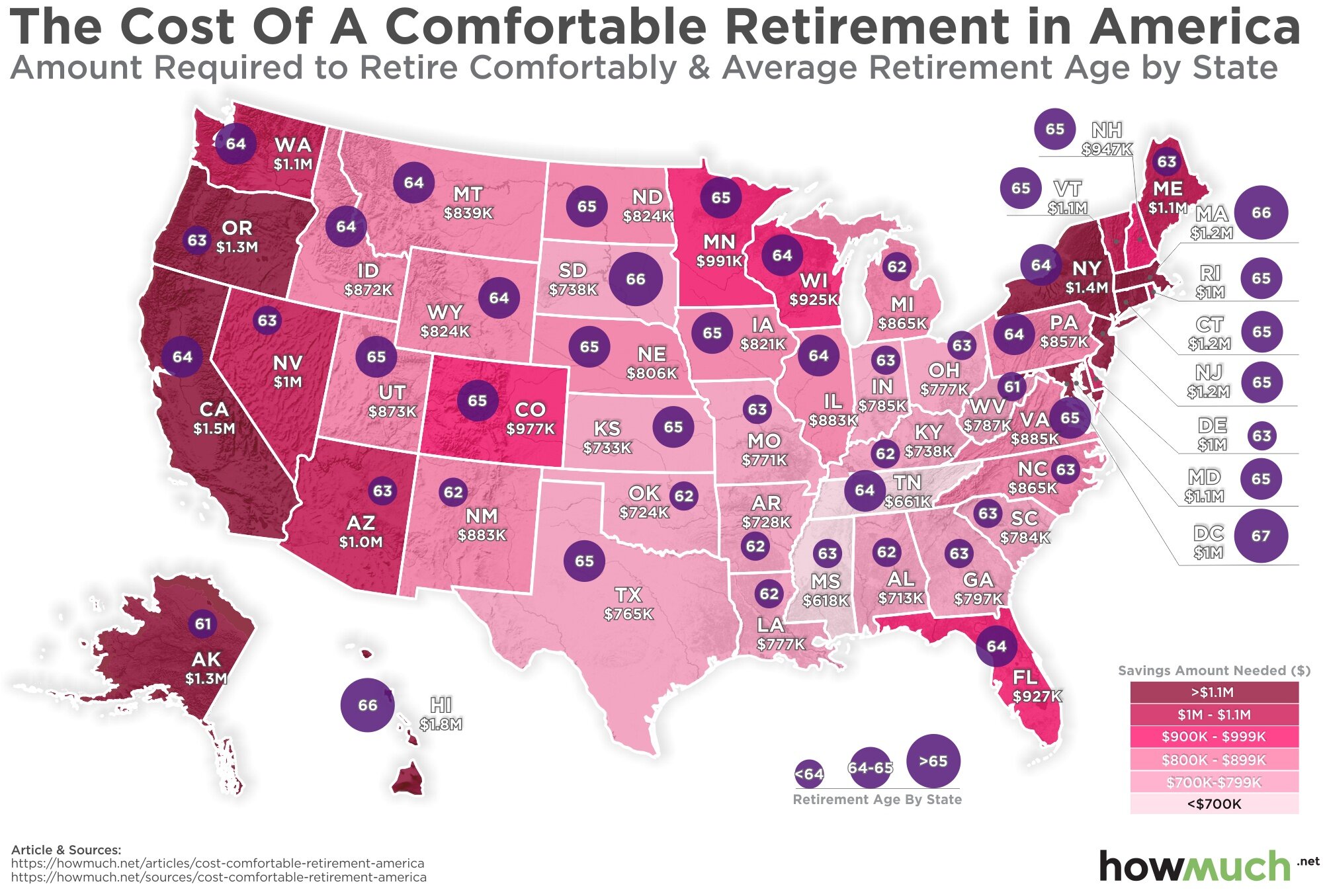

Figuring out how much you need in retirement comes down to several criteria, one being the cost of living. This figure will help to determine how long your nest egg may last. Based on spending habits and life expectancy, the average 65-year-old retired American will spend ~$987,000 from their retirement onward.

For those with limited resources or a tight budget, retiring in states such as California (~$1.5M) or Massachusetts or New York (~$1.4M) may prove more challenging, as a dollar doesn’t stretch as far as it does in Tennessee (~$661K) and Alabama (~$713K).

Currently, Mississippi (~$618K) is lower than anywhere else in the country. The chart below from “Mapped: How Much Money Do You Need to Retire Comfortably in Each State?” shows the average age of retirement and the amount needed to retire “comfortably.”

Source: HowMuch.Net.

While residing in a lower-cost state can save a considerable amount of money, it is only one of the many factors that should be taken into consideration.

Taxes

While the cost of living is important, how much you pay in state income taxes also plays a role in affordability and the ability to maintain a desired lifestyle. While some states are considered more “tax-friendly” than others, most retirees rely on a combination of three income sources:

Social Security: Currently, 37 states do not tax Social Security benefits.If you enjoy larger benefit amounts, avoiding state taxes is a plus. It should be noted that the 13 states taxing Social Security vary by adjusted gross income or other criteria, so a portion of your benefits may not end up being taxable.

Pensions: Fourteen states do not impose a tax on pension benefits. If you’re collecting multiple pensions, this can be a significant amount of tax savings. There are several states that only tax a portion of pension income.

Defined contribution retirement plan [e.g., 401(k)]: Currently, 12 states do not impose taxes on retirement plan withdrawals, which boosts your net take-home if you live in one of those states. This is beneficial when you reach your required minimum distribution (RMD) age. For many, RMDs can be north of $100K per year, which could propel them into a higher tax bracket.

The saying “There’s no such thing as a free lunch” rings true. While certain states don’t tax Social Security, they often have added sales tax to essentials such as groceries or clothing, or charge higher property taxes to partially offset the state tax “savings.” While saving money in taxes is always a good thing, it is one of many factors that should be considered prior to deciding to move in retirement.

Remember, a state can’t properly function without collecting income taxes or otherwise generating tax revenue to invest in needs such as education, sanitation, health care, and other projects.

This does not mean that all states are created equal but deciphering which is “best” is not as simple as it sounds.

Quality-of-Life Questions

It’s essential to determine if the grass will actually be greener before committing to a move. Before making a decision, for example, be sure that your intended destination is likely to improve your quality of life.

You have several non-monetary factors to think about with moving in retirement:

You may need to create a new network of friends.

It could put you farther away from family and close friends.

You may need to adapt to different weather/climate.

It will require you to find new health care providers and medical care clinics.

For many, the allure of a new location is worth the adjustment and effort of creating a new social network. Moving from a colder, more expensive state to a warm-weather and lower-living-cost state is a popular journey for many seniors. You might find a built-in community if you move to an area popular with retirees. You must also weigh the option of whether you prefer to live in a big city or a quieter rural location.

Accessibility and health care is also a main concern for pre-retirees considering a retirement move. Your new landing spot should be outfitted with aging in mind, which might mean having an elevator in a tall building, accessible walking paths, readily available public transportation, or grocery stores within walking distance.

AARP keeps a livability index on its website, where you can enter an address, city, state, or zip code. The index scores your entry, looking at the available services and amenities that could impact your life the most.

The AARP index is one easy way to explore how livable a potential community might be and how moving somewhere may affect your quality of life.

Bottom Line

Planning where to live in retirement will end up being a large part of planning your retirement income and expenses. Downsizing and reducing costs will help you prepare for other expenses and potentially boost your quality of life.

Alternatively, if you choose to move to a higher-cost area, you need to build that into your retirement projections and ensure your nest egg is large enough to handle the additional expenses that will come your way.

In the end, any state has its retirement pros and cons, and you should view your decision from multiple lenses. Moving somewhere new in retirement is a big adjustment and will take time for you to get acclimated to your surroundings.

Ultimately, where you end up somewhat depends on what you can afford and what makes you happy. Working with a financial advisor can help answer the question of how much you can afford.

Discuss your situation with a fee-only financial advisor.

The commentary on this website reflects the personal opinions, viewpoints and analyses of the Divergent Planning, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Divergent Planning, LLC or performance returns of any Divergent Planning, LLC Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Divergent Planning, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Divergent Planning, LLC provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Divergent Planning, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Divergent Planning, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Divergent Planning, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Divergent Planning, LLC unless a client service agreement is in place.

General Notice to Users: While we appreciate your comments and feedback, please be aware that any form of testimony from current or past clients about their experience with our firm on our website or social media platforms is strictly forbidden under current securities laws.

© Divergent Planning