Rather watch Ara explain the market commentary in a video? Click here to watch.

While most markets have come roaring back with a vengeance, there is one that continues to lag and has people worried about the long-term consequences. This would be the commercial real estate (CRE) market.

Stubbornly high inflation, massive interest rate hikes, and the recent regional banking “crisis” have this market in a tough spot. In addition, with a large percentage of employees continuing to work from home (WFH), the long-term viability of this market has come into question, and people are wondering whether another crisis is around the corner. As we know, no one can accurately predict such a thing, but we have a few important pieces of information to consider.

WHAT IS CRE?

First, it’s important to define what commercial real estate is. It refers to an investment used for business activities and includes segments such as office space and retail, industrial, and multifamily residential projects. Each is impacted differently based on factors ranging from economic growth, to manufacturing activity, to retail spending. It is not abnormal to see some segments excel while others struggle during various periods.

VACANCY RATES

According to the National Association of Realtors, office space vacancy rose from pre-pandemic levels of 9.4% to ~12% by the end of 2022. This increase should not be a shock, given how many people worked from home during the pandemic. While many workers have returned to the office or employ a hybrid model, a large swath continues to work from home and likely will for the foreseeable future.

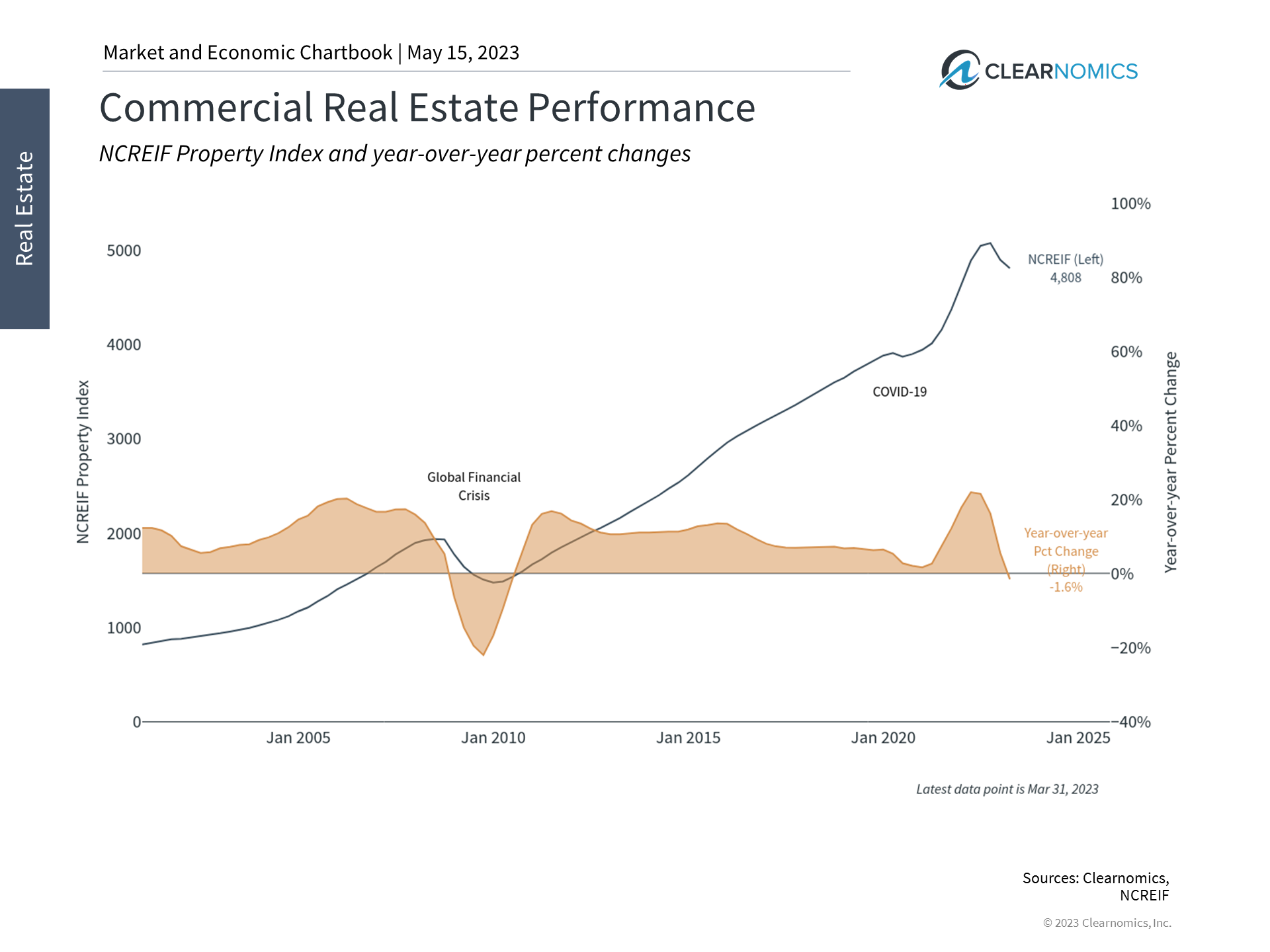

The CRE market has declined by ~1.6% over the past year, largely attributable to softness in the office space market. While news coverage has focused on the struggles within the office space sector, it has glossed over the positives in the hotel (retail) and industrial markets, which have seen property price increases over the same period.

While the work-from-home percentage has plummeted from its peak of 61.5% (Q1 2022) to 29.3% (Q1 2023), it is still over 6x what it was at the end of 2019!

One point to keep in mind is that vacancy rates vary widely from city to city, and analyzing only a few rates does not accurately represent the entire office space market. For example, the vacancy rate is ~14% in Washington, DC but only ~5.5% in Louisville, Kentucky.

BANKS

CRE projects require an immense amount of capital, which usually comes in the form of financing. Much of the financing originates from small and medium-sized regional banks, which have been negatively impacted by the ~5% spike in interest rates last year. This impact has led to a slowdown in lending for new projects and will affect existing loans that require refinancing.

According to the Financial Stability Report by the Federal Reserve, small and mid-size banks hold ~87% of the CRE loans by dollar value, putting the total at ~$1.6 trillion. This can put a lot of stress on small and medium banks if interest rates remain elevated for an extended period.

The positive is the banking system seems to be healthy despite the collapse of Silicon Valley Bank and the precipitous decline of First Republic, which JPMorgan ultimately purchased. While further volatility is likely, it seems the issue is isolated to a few banks and not affecting the overall banking system.

HISTORICAL INTEREST RATES

While interest rates increased at a historic pace last year to combat inflation, the Fed Funds Rate is far above long-term market rates. This action caused panic and shock to markets last year. But if inflation continues to subside, the Federal Reserve will likely cut interest rates in 2024, which would be a welcomed relief to the CRE segment.

While risks remain, the health of the CRE market remains on solid footing. Although pockets of weakness are likely to continue, a repeat of a 2008-like crisis seems highly unlikely. The economy has been extremely resilient in the face of higher interest rates. If we see rates start to come down in 2024, things should work themselves out in an orderly fashion.

Discuss your situation with a fee-only financial advisor.