Rather watch Ara explain the market commentary in a video? Click here to watch.

Like we always do at the beginning of each year, we hope for less uncertainty and more calm in the year ahead. Unfortunately, given this is an election year, periods of heightened volatility are likely. While the upcoming election is garnering most of the headlines, another issue needs to be addressed in short order. Otherwise, more volatility is likely.

Lawmakers once again need to agree upon and approve a new budget after passing two short-term funding agreements. Adding this variable in a presidential election year has some worried about what’s to come. The divide between and within the two political parties seems to have widened over the past few years. While not ideal, it does not necessarily equate to a negative scenario for markets. And while alarming, it’s important to make the distinction between the current budget situation and the debt ceiling issue.

Federal Debt

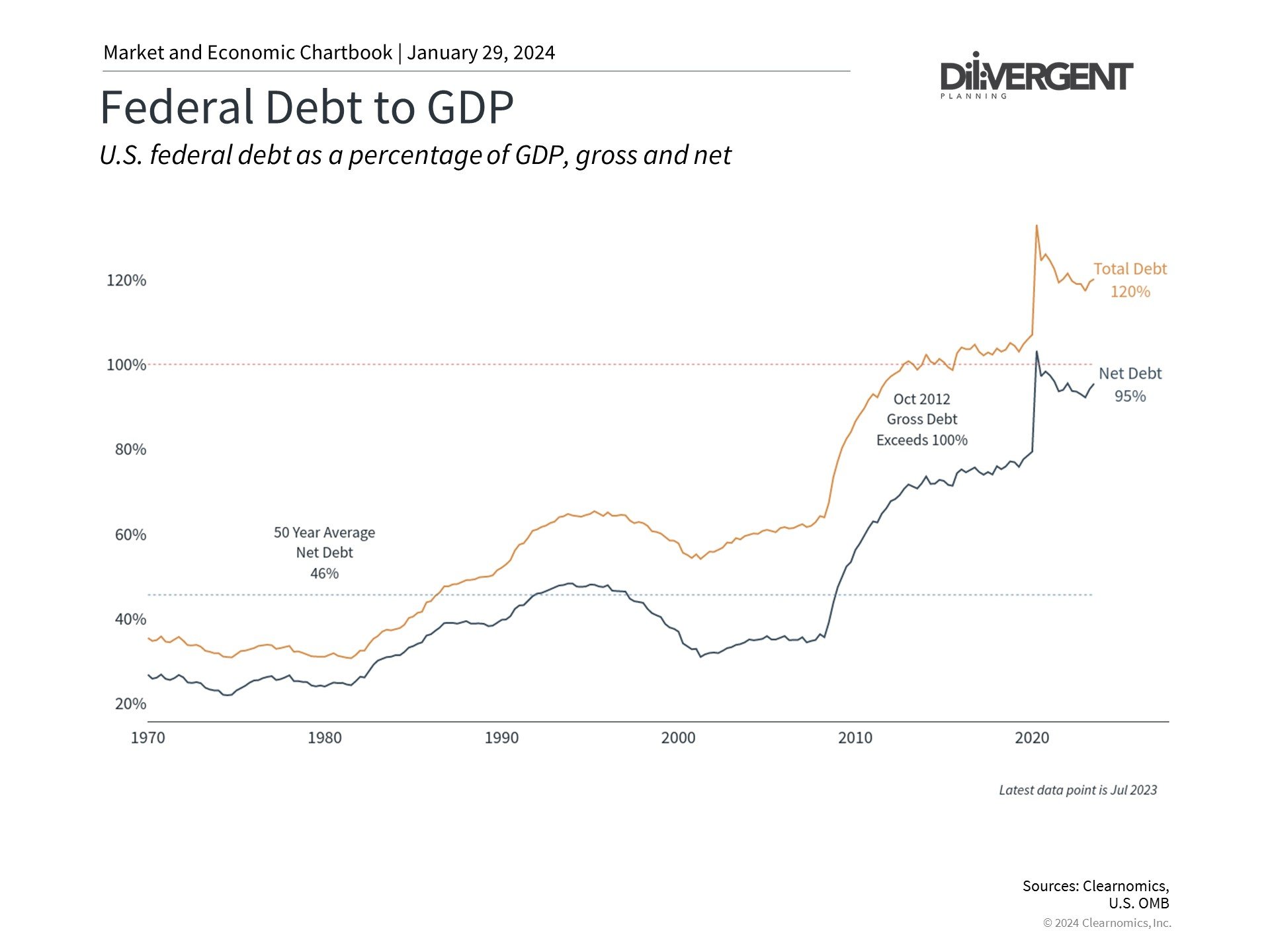

It’s no secret that federal debt has risen over the past two decades, with a significant spike during the pandemic. While it did slightly decline in 2021 and 2022, it’s starting to creep higher again.

Gridlock in Congress is certainly nothing new, as it seems like a potential shutdown scenario occurs every few months now. Congress recently passed a stopgap bill until early March, which means they must either pass budget appropriations or agree on another funding extension. So yes, in a few weeks, the drama will likely start yet again!

The federal government has been operating at a deficit since 2001 and is currently north of $34 trillion. The deficit has increased by over tenfold since the early 2000s. The percentage of U.S. treasuries held by the U.S./U.S. government has skyrocketed in the past 10 years.

While balancing the federal budget has been an afterthought for much of the past decade, there is a distinct difference between the federal budget and the debt ceiling. The government regularly operates with a budget deficit, meaning it spends more than it collects in revenues (think taxes).

To make ends meet, the government must borrow more to meet its financial obligations. The limit on borrowing, aka the debt ceiling, needs to be extended and has led to many political standoffs over the years.

As seen on the chart above, the issuance of U.S. treasuries continues to increase as we borrow more year after year. If a household operates in this manner for an extended period, they will eventually be cut off and face significant financial repercussions. Luckily, the federal government has much deeper pockets!

Unfortunately, the next debt ceiling debate will take place soon after the presidential election, which likely means more political posturing. Now, the risk of not passing an approved budget is a government shutdown, and while not ideal, the repercussions can be contained if it's dealt with in a timely manner.

On the other hand, not raising the debt limit can lead to the government defaulting on its debt. This would likely bring about multiple negative ripple effects and a gigantic spike in volatility and economic uncertainty.

Taxes

There are two main ways of balancing a budget: reduced spending or increased revenues. Reducing our spending of any magnitude seems unlikely, which means increasing revenues is the likely avenue. This typically comes in the form of higher taxes. While an increase in taxes is never the desired outcome, tax rates really haven’t increased much in the last 30 years!

To put things in perspective, the last time the U.S. government had a balanced budget was when Bill Clinton was president, back in 2001! Yes, it’s been over three decades, and there are no simple and pain-free solutions to get back to that.

As it stands, unless extended by Congress, the 2017 Tax Cuts and Jobs Act is set to sunset in 2026, which among other things, could lead to a spike in taxes for millions of American households.

The good news: cooler heads tend to prevail, and a deal is generally struck at the last minute. You could make the case that the risks today are bigger, given the magnitude of our total debt. At the same time, our borrowing power has also increased.

Even with concerns of a new federal budget, the debt ceiling, and the presidential election on the horizon, this does not spell doom for your portfolio. History, in fact, shows that markets actually tend to perform pretty well in similar circumstances. Could this time be different? Sure, but I wouldn’t bet on it.

Discuss your situation with a fee-only financial advisor.