Rather watch Ara explain the market commentary in a video? Click here to watch.

Don’t look now, but most equity markets are at or near all-time highs. While this may not seem like such a big leap considering the sharp decline in 2022, the truth is no one saw THIS coming.

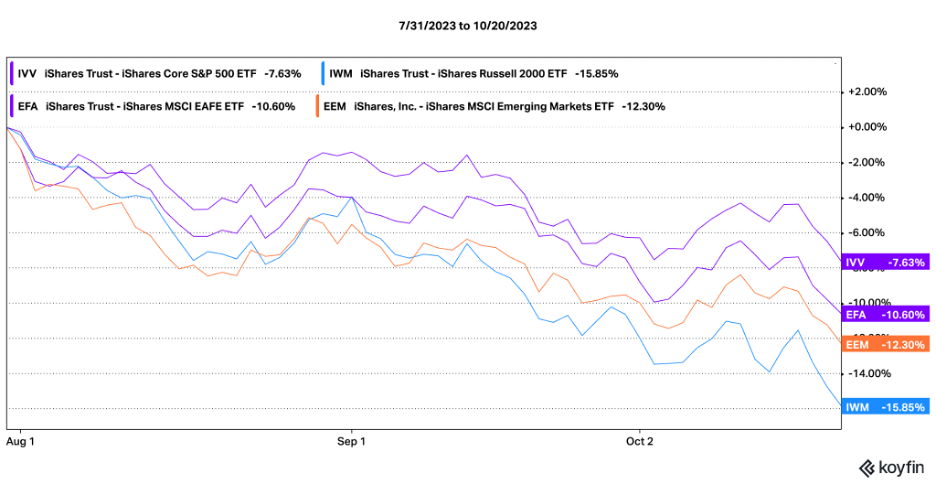

A mere four months ago, markets were coming off a tough stretch as expectations for higher interest rates, stickier inflation, and a recession were still top of mind. Worries mounted that a recession was inevitable and that higher rates were here for the foreseeable future. As seen in the chart below, this situation led to a sizable decline in the major equity markets.

Well, it didn’t take long, as the returns since late October were remarkable, witnessed by the rally in the major equity markets!

How Investors Respond to Rallies Like This

A rally of this magnitude tends to grab people’s attention. Why did markets move so much in a seven-month stretch? Well, because we humans are the ones who control markets, and our emotions can get the best of us in good or bad times.

Much of the rally can be attributed to the decline in many inflation data points and the Federal Reserve’s softer stance on interest rates.

Many investors grow nervous and hesitate to invest when markets are at record levels, as they are deemed “expensive.” While some level of nerves is expected for investors, markets tend to rally more once all-time highs are reached.

Those nerves eventually get replaced with optimism and can give way to irrational exuberance. It’s interesting how quickly some flip from fear to greed during these market cycles. This commentary explores how markets typically behave as we reach all-time highs and why making drastic changes is not warranted.

More Common Than You Think

As seen on the chart below, minus the 1970s (energy crisis, Vietnam War, Watergate scandal) and 2000s (dot-com bubble, September 11th attacks, and the 2008 Financial Crisis), all-time highs are a pretty common occurrence.

Since the 1950s, the S&P has posted over 1,240 new highs, which averages to more than 17 per year or, said another way, more than one in every 20 trading days! The takeaway? All-time highs are fairly common and should be embraced, not feared. Of course, each situation is unique, but history paints all-time highs with an optimistic outlook, not one to fear.

JPMorgan took a closer look into investing at all-time highs and found that over the past 35 years, returns have actually been higher if you only invested at all-time highs vs. any other day! This finding is remarkable and counterintuitive, as most would expect the opposite.

Source: https://www.jpmorgan.com/content/dam/jpm/securities/documents/cwm-documents/Is-it-worth-considering-investing-at-all-time-highs.pdf.

This Time Is Different?

I can already anticipate the pushback and explanations about why this time will be different. Many will bring up the following:

Markets, from a historical perspective, are “expensive.”

Geopolitical tensions are flaring up.

We’re likely to have a drama-filled election in November.

Soaring U.S. government debt and a divided Congress make real budget progress difficult.

Honestly, while most are valid concerns, markets have a way of climbing the wall of worry and pushing ahead. Why? Because this is what markets do. There are always things to worry about—that’s a given. But the reality is, most often, the worries are overblown, and circumstances work themselves out in an orderly manner. Now, occasionally, periods like 2008 occur, where the fallout is far worse, but thankfully, those times are far and few between.

Does this mean that 2024 will be a cakewalk? Of course not. But using history as a guide tells us that markets will be near or at all-time highs far more often than we think. This is just how markets work.

The Importance of Diversification

What if you are not one of the lucky ones? What if you retire right as we dive into a bear market? The answer is preparation. While an unlikely scenario, having a diversified portfolio of stocks and bonds and a healthy cash reserve is vital and something we stress, as you do not want to be a forced seller during these periods.

Investing is hard and will test your patience many times. Hindsight is 20/20, and it’s easy to say, “Of course markets will recover—they don’t stay down forever.” But while they are down, we can feel helpless. The same can be said when markets hit all-time highs, as many equate a record high to an imminent sell-off. History tells us just the opposite. Stay the course!

Discuss your situation with a fee-only financial advisor.