This blog has been updated with new information from its original versions, previously published on January 10, 2025, and May 16, 2022.

One of the biggest financial concerns among retirees is the cost of health care. Unfortunately, most employees lose their employer-sponsored health insurance at retirement. The few workplaces offering retiree health insurance typically do so at a very hefty price. However, the federal government is an exception, as it offers retiree health insurance at an extremely affordable rate.

The Federal Employees Health Benefits (FEHB) insurance plan is the largest employer-sponsored group health insurance program, covering over 8 million people worldwide! Given how comprehensive FEHB is, retirees face the decision of whether they need both the FEHB plan and Medicare Part B. Since federal employees have many options for health insurance, it’s important to educate yourself before deciding.

Whether you should enroll in Medicare Part B, even though you have FEHB, depends on your situation, since there is no “one size fits all” approach. The article covers important considerations to help you decide.

The Basics of Medicare and FEHB Coverage

Let’s start with the basics. While working, you pay into the Medicare system. Part A, which covers basic hospitalization, is premium-free in retirement for nearly all working adults. Along with Part A, Medicare has additional separate parts:

Part B: Covers a majority of medical expenses

Part D: Offers prescription drug coverage through private insurance

You can also enroll in various Medicare Advantage plans, called Part C.

Most federal employees enjoying FEHB coverage can continue it into retirement if they are eligible for an immediate FERS pension and have been enrolled in FEHB for the five years before retirement or when first eligible. For more information on eligibility requirements, please reference the OPM website.

FEHB is perhaps the most valuable benefit provided to federal employees and their families, which begs the question of whether enrollment in Medicare Part B is necessary. Before we dive into the ins and outs of FEHB vs. Medicare Part B, let’s first look at who is eligible for Medicare. Most people who fit into one of the following categories can take advantage of Medicare:

People age 65 and older

People younger than 65 with specific disabilities

People of any age with end-stage renal disease, which includes renal failure requiring either a transplant or regular dialysis

One thing of note: If you plan on retiring before age 65, you will need to enroll in a private health insurance plan unless covered by a spouse’s employer health care plan or are eligible for FEHB benefits.

Private health insurance needs to be factored into your financial planning projections since plans can cost north of $10,000/year per person! With FEHB, the government subsidizes ~75% of the premium, making it an attractive option.

How Does Medicare Work?

When enrolling, keep in mind that the Medicare plan known as “original,” covering Parts A and B, is operated by Medicare. Medicare Advantage policies are conducted by independent insurance providers but cover similar costs as Parts A and B.

You don’t have to re-enroll in Medicare each year, although you do get an opportunity to change your plan during the yearly open enrollment period.

In many ways, Medicare works like private insurance, and you usually must meet a deductible and pay for your share of services and supplies when you receive them. In addition to medically necessary services, Medicare will also pay for many preventive services, including screenings and shots.

Also, most federal employees keeping FEHB do not need to enroll in Medicare Part D since their prescription drug benefits are covered.

Who Should Consider Part B Plans?

Medicare Part B provides outpatient/medical coverage, including ambulance services, home health services, X-rays, and durable medical equipment, to name a few. Medicare Part B doesn’t replace FEHB, but rather supplements it. Medicare becomes the primary insurance and pays for your services first, with FEHB being secondary. Part B is a fee-for-service plan, which means you’ll pay a small out-of-pocket fee each time you use the services.

Since Part B carries a 10% annual delayed enrollment penalty, your decision becomes even more important. To read more about Medicare B eligibility, please reference this article.

If you join Part B, you have the benefit of going outside your FEHB doctor network and paying only 20% of the Medicare allowed charge. This is a plus for those who seek flexibility or plan to move in retirement and want access to a wider network of doctors.

Some individuals under the federal retirement system should consider Part B coverage. They include anyone who has a fee-for-service plan, individuals with certain Government Employee Health Association (GEHA) coverage, and mail handlers. The reason is Medicare Part B can work in conjunction with your federal retiree health benefits to waive your copays and deductibles. This can potentially help offset the costs of Medicare Part B premiums as you will essentially be 100% covered. If you had a large medical expense, the savings alone could outweigh the cost of Medicare Part B premiums in just one year.

Some Medicare plans are designed to reimburse FEHB retirees for a portion of their Medicare Part B premium, even if they are subject to some late enrollment penalties or IRMAA. These plans can help provide you with more benefits and coverage without needing to pay the full amount of the higher premium.

Part B isn’t always necessary for retirees with an HMO plan simply because HMOs typically cover most services and require only small copayments. While FEHB covers emergencies if you travel abroad, it doesn’t cover routine medical care while abroad.

How Do FEHB and Medicare Work Together?

While it can seem like FEHB and Medicare Part B coverage are relatively the same, that isn’t the case. If you pass on Part B, then FEHB continues to be your primary payer.

For government retirees, combining Medicare Parts A and B with FEHB means you are likely to have close to 100% coverage of almost all medical expenses, which provides peace of mind. Unfortunately, this peace of mind isn’t free and could cost more than anticipated.

The good news is that federal retirees who have FEHB and Medicare A and B don’t need a “Medigap” plan. FEHB serves as just that, covering most of what Medicare doesn’t. The result is little to no out-of-pocket expenses throughout retirement.

That said, Part B premiums are based on income, which could mean significantly higher premiums for some. This increase could drastically diminish the amount saved by having both FEHB and Part B.

It should be noted that some FEHB plans provide some portion of Medicare Part B reimbursement. Currently, for example, the Blue Cross Basic plan does, while the Blue Cross Standard plan does not. So if you are enrolled in Part B, it’s important that you check your plan to see if you qualify.

While current FEHB benefits are phenomenal, there’s a chance the government could cut them in cost reduction measures or reduce the FEHB subsidy. Recently, Congress passed H.R. 3076, which required the Postal Service to pre-fund its retiree health benefit costs and all postal workers to enroll in Medicare Parts A and B upon turning 65. The question is whether this requirement will become the standard for all federal employees.

Medicare Surcharges

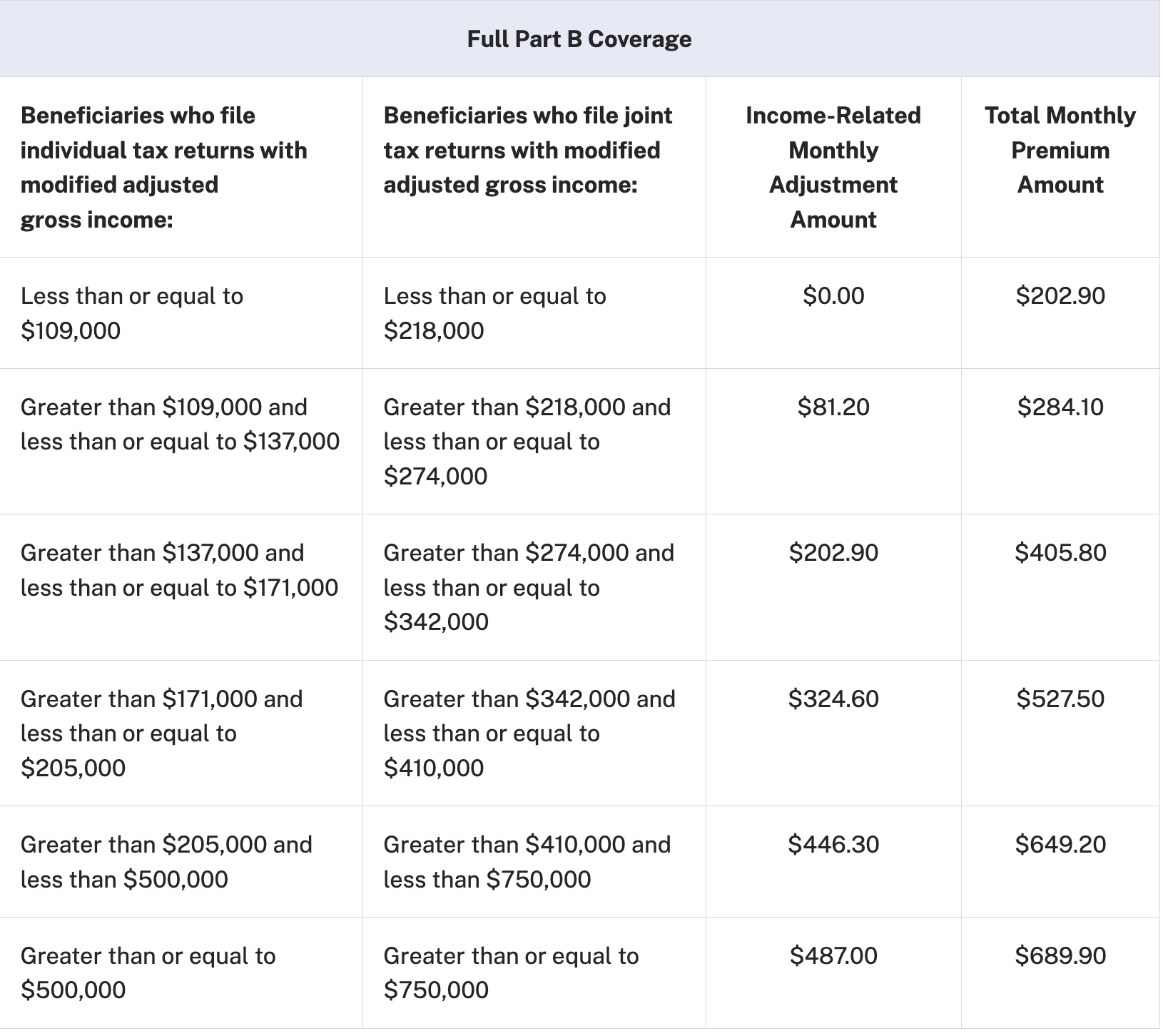

Medicare premiums are based on your modified adjusted gross income (MAGI). The standard Part B premium in 2026 is $202.9/month per individual, which is an increase of ~10% from the previous year of $185/month. As an FYI, Medicare uses the MAGI reported on your tax return from two years prior in determining your Part B premium.

Unfortunately, those with elevated income could see premiums increase by as much as 340% (although you may be eligible for a reprieve). Medicare Part D premiums are also subject to surcharge premiums, albeit at a much lower amount. These surcharges are referred to as the Medicare income-related monthly adjustment amount, also IRMAA.

It goes without saying that health care decisions should never be made solely on cost, but it is something that should be taken into consideration.

Your MAGI mainly comprises the following:

Taxable portion of Social Security (gross)

Pension income (gross)

Rental income (net)

Part-time retirement income

Interest, dividends, and capital gains

IRA or employer-sponsored plan withdrawals

The last bullet point is what trips many up in retirement.

2026 Part B Premiums

Source: CMS.gov.

People often assume they will be in a lower tax bracket throughout retirement. While that is the case for some retirees, others are often shocked to learn they will be in a significantly higher income bracket for an extended period. For higher-income retirees, not only will they end up paying more in taxes, but those enrolled in Parts B and D will likely pay higher IRMAA charges.

For some retirees, a FERS pension and Social Security alone can be enough to trigger IRMAA. Once required minimum distributions (RMDs) get added to the equation, Medicare premiums can increase to over $8,000/year per person since RMDs alone can equal several hundred thousand dollars of “income” per year!

This can quickly add up to north of $175,000 of IRMAA premiums over a 10- to 15-year period! This means that federal employees may pay much more in IRMAA for Part B than they save by having it, making it a losing choice in some cases.

Roth conversions are a common tax and estate planning strategy for many retirees. If you are over age 65 and paying for Part B, any amount converted is taxed as income and could increase your IRMAA charges. A Roth conversion could still be beneficial, but it may end up costing more than you realize!

This is where FEHB shines, as it’s not subjected to an earnings test. The premium remains the same regardless of your income! Whether to enroll in Part B is more complicated for higher-income retirees, which is why it’s recommended that you have a financial plan in place to help you make these tough decisions.

Conclusion

Deciding whether to enroll in Medicare Part B alongside FEHB can be overwhelming, as there are several things to consider before choosing. Your decision is important, and your expected retirement income should play a role in making this decision, but should not be the end-all, be-all.

If you have additional questions about FEHB versus Medicare coverage, you can visit the government’s Office of Personnel Management website for information. You can also seek the services of a fee-only, fiduciary financial planning firm to help you plan for things such as this during the financial planning process. Our Bethesda, MD financial planning firm routinely helps our federal employee clients make Medicare–FEHB decisions as part of their planning.

Discuss your situation with our financial planning firm.

The commentary on this website reflects the personal opinions, viewpoints and analyses of the Divergent Planning, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Divergent Planning, LLC or performance returns of any Divergent Planning, LLC Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Divergent Planning, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Divergent Planning, LLC provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Divergent Planning, LLC is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.

Divergent Planning, LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Divergent Planning, LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Divergent Planning, LLC unless a client service agreement is in place.